Catastrophe Claims Data and Reporting

Overview

In the event of a hurricane or other natural disaster causing catastrophic damage in the State of Florida, it will likely become necessary for the Florida Office of Insurance Regulation (Office) to institute a data call for the purposes of collecting claims and other relevant information from insurance companies. This authority is mandated pursuant to Section 624.307, Florida Statutes.

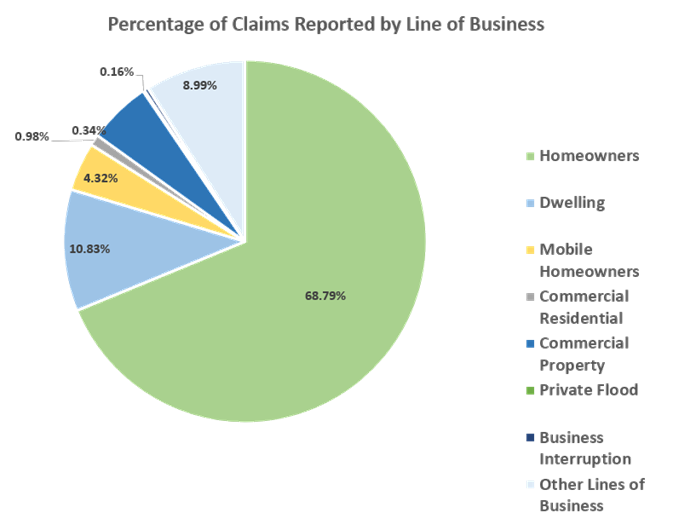

Insurance companies will be notified when to begin reporting county and statewide information related to the event and how to submit it using the current year's Catastrophe Reporting Form. General company, contact and statewide modeling information along with claims data addressing the following lines of business will be collected: homeowners, dwelling, mobile homeowners, commercial residential, commercial, private flood, business interruption, and other. Companies upload the requested information via the Insurance Regulation Filing System (IRFS) at specified time intervals as determined by OIR.

OIR may use the aggregated data in summary reports and other materials in order to provide the general public with information concerning the impact of a catastrophic event on Florida’s insurance industry.

Catastrophe Reporting Resources

For questions regarding Catastrophe Reporting forms, please email disasterreporting@floir.com.

- Form CRF-22A: Catastrophe Reporting Form 2022

- 2022 CRF Frequently Asked Questions

- Form CRF-20A: Catastrophe Reporting Form 2020

- Form CRF-19A: Catastrophe Reporting Form 2019 version 2

- Form CRF-19: Catastrophe Reporting Form 2019

- Survey Notice: Hurricane Michael Claims Survey

- Form CRF-18: Catastrophe Reporting Form 2018

- Form CRF-17: Catastrophe Reporting Form 2017

Hurricane Claims Data

Total Estimated Insured Losses: $309,530,946

Data as of November 16, 2023

| Lines of Business | Number of Claims | Number of Open Claims with Payment | Number of Open Claims without Payment | Number of Claims Closed with Payment | Number of Claims Closed without Payment | Percent of Claims Closed |

| Residential Property | 17,005 | 2,404 | 1,456 | 7,075 | 6,070 | 77.3% |

| Homeowners | 11,586 | 1,561 | 1,066 | 4,134 | 4,825 | 77.3% |

| Dwelling | 1,585 | 195 | 195 | 550 | 645 | 75.4% |

| Mobile Homeowners | 3,710 | 642 | 157 | 2,342 | 569 | 78.5% |

| Commercial Residential | 124 | 6 | 38 | 49 | 31 | 64.5% |

| Commercial Property | 1,258 | 162 | 527 | 273 | 296 | 45.2% |

| Private Flood | 452 | 125 | 199 | 89 | 39 | 28.3% |

| Business Interruption | 19 | 5 | 7 | 6 | 1 | 36.8% |

| Other Lines of Business* | 6,313 | 498 | 738 | 4,100 | 977 | 80.4% |

| TOTALS | 25,047 | 3,194 | 2,927 | 11,543 | 7,383 | 75.6% |

*Other Lines of Business may include Fire, Farmowners’ Multi-Peril, Ocean Marine, Inland Marine, Private Passenger Automobile Physical Damage, Commercial Auto Physical Damage, Aircraft, Glass, Boiler and Machinery, Industrial Fire, Industrial Extended Coverage, and Multi-Peril Crop.

Claims Data by County for Top 20 Counties

| County | Number of Claims | Number of Open Claims with Payment | Number of Open Claims without Payment | Number of Claims Closed with Payment | Number of Claims Closed without Payment | Percent of Claims Closed |

| Suwannee | 3,024 | 623 | 187 | 1,739 | 475 | 73.2% |

| Taylor | 2,898 | 602 | 287 | 1,555 | 454 | 69.3% |

| Pinellas | 1,975 | 135 | 176 | 788 | 876 | 84.3% |

| Madison | 1,727 | 354 | 156 | 957 | 260 | 70.5% |

| Hillsborough | 1,534 | 99 | 299 | 547 | 589 | 74.1% |

| Pasco | 1,340 | 118 | 131 | 516 | 575 | 81.4% |

| Hamilton | 962 | 170 | 70 | 593 | 129 | 75.1% |

| Citrus | 921 | 94 | 113 | 322 | 392 | 77.5% |

| Columbia | 832 | 118 | 64 | 451 | 199 | 78.1% |

| Duval | 816 | 58 | 86 | 350 | 322 | 82.4% |

| Leon | 615 | 52 | 52 | 258 | 253 | 83.1% |

| Lafayette | 611 | 167 | 56 | 322 | 66 | 63.5% |

| Dixie | 601 | 56 | 70 | 320 | 155 | 79.0% |

| Sarasota | 514 | 21 | 86 | 185 | 222 | 79.2% |

| Charlotte | 481 | 48 | 51 | 232 | 150 | 79.4% |

| Hernando | 469 | 44 | 88 | 154 | 183 | 71.9% |

| Manatee | 443 | 33 | 61 | 136 | 213 | 78.8% |

| Orange | 411 | 21 | 63 | 134 | 193 | 79.6% |

| Lee | 407 | 17 | 55 | 169 | 166 | 82.3% |

| Alachua | 377 | 38 | 45 | 171 | 123 | 78.0% |

| All Other Counties | 4,466 | 326 | 731 | 1,644 | 1,388 | 67.9% |

| TOTALS | 25,047 | 3,194 | 2,927 | 11,543 | 7,383 | 75.6% |

*Other Lines of Business may include Fire, Farmowners’ Multi-Peril, Ocean Marine, Inland Marine, Private Passenger Automobile Physical Damage, Commercial Auto Physical Damage, Aircraft, Glass, Boiler and Machinery, Industrial Fire, Industrial Extended Coverage, and Multi-Peril Crop.

Total Estimated Insured Losses: $21,386,266,489

Data as of April 22, 2024

| Lines of Business | Number of Claims | Number of Open Claims with Payment | Number of Open Claims without Payment | Number of Claims Closed with Payment | Number of Claims Closed without Payment | Percent of Claims Closed |

| Residential Property | 558,299 | 24,180 | 13,369 | 362,626 | 158,124 | 93.3% |

| Homeowners | 454,072 | 20,259 | 11,463 | 286,786 | 135,564 | 93.0% |

| Dwelling | 57,451 | 2,950 | 1,672 | 37,912 | 14,917 | 92.0% |

| Mobile Homeowners | 42,861 | 491 | 87 | 35,839 | 6,444 | 98.7% |

| Commercial Residential | 3,915 | 480 | 147 | 2,089 | 1,199 | 84.0% |

| Commercial Property | 33,010 | 4,508 | 4,383 | 11,363 | 12,756 | 73.1% |

| Private Flood | 5,645 | 378 | 85 | 3,705 | 1,477 | 91.8% |

| Business Interruption | 582 | 25 | 21 | 411 | 125 | 92.1% |

| Other Lines of Business* | 179,405 | 1,097 | 998 | 151,764 | 25,546 | 98.8% |

| TOTALS | 776,941 | 30,188 | 18,856 | 529,869 | 198,028 | 93.7% |

*Other Lines of Business may include Fire, Farmowners’ Multi-Peril, Ocean Marine, Inland Marine, Private Passenger Automobile Physical Damage, Commercial Auto Physical Damage, Aircraft, Glass, Boiler and Machinery, Industrial Fire, Industrial Extended Coverage, and Multi-Peril Crop.

Claims Data by County for Top 20 Counties

| County | Number of Claims | Number of Open Claims with Payment | Number of Open Claims without Payment | Number of Claims Closed with Payment | Number of Claims Closed without Payment | Percent of Claims Closed |

| Lee | 272,299 | 12,767 | 4,910 | 200,612 | 54,010 | 93.5% |

| Charlotte | 104,755 | 6,079 | 1,150 | 83,829 | 13,697 | 93.1% |

| Sarasota | 78,537 | 2,801 | 1,320 | 53,967 | 20,449 | 94.8% |

| Collier | 46,767 | 925 | 1,007 | 30,071 | 14,764 | 95.9% |

| Volusia | 41,552 | 995 | 749 | 25,485 | 14,323 | 95.8% |

| Orange | 35,290 | 1,109 | 1,273 | 18,465 | 14,443 | 93.3% |

| Polk | 27,835 | 687 | 791 | 17,770 | 8,587 | 94.7% |

| Hillsborough | 17,704 | 492 | 718 | 9,178 | 7,316 | 93.2% |

| Manatee | 13,977 | 338 | 343 | 8,050 | 5,246 | 95.1% |

| Osceola | 12,472 | 498 | 527 | 6,662 | 4,785 | 91.8% |

| Seminole | 11,793 | 243 | 314 | 6,005 | 5,231 | 95.3% |

| Broward | 6,917 | 420 | 1,227 | 3,096 | 2,174 | 76.2% |

| Miami-Dade | 6,811 | 443 | 1,415 | 2,781 | 2,172 | 72.7% |

| Highlands | 6,766 | 140 | 167 | 4,703 | 1,756 | 95.5% |

| DeSoto | 6,397 | 226 | 56 | 5,150 | 965 | 95.6% |

| Brevard | 5,796 | 110 | 185 | 3,215 | 2,286 | 94.9% |

| Palm Beach | 5,157 | 281 | 683 | 2,549 | 1,644 | 81.3% |

| Pinellas | 4,907 | 118 | 148 | 2,356 | 2,285 | 94.6% |

| Lake | 4,834 | 101 | 158 | 2,641 | 1,934 | 94.6% |

| St. Lucie | 3,160 | 113 | 236 | 1,859 | 952 | 89.0% |

| All Other Counties | 63,215 | 1,302 | 1,479 | 41,425 | 19,009 | 95.6% |

| TOTALS | 776,941 | 30,188 | 18,856 | 529,869 | 198,028 | 93.7% |

*Other Lines of Business may include Fire, Farmowners’ Multi-Peril, Ocean Marine, Inland Marine, Private Passenger Automobile Physical Damage, Commercial Auto Physical Damage, Aircraft, Glass, Boiler and Machinery, Industrial Fire, Industrial Extended Coverage, and Multi-Peril Crop.

Total Estimated Insured Losses: $253,086,983

Data as of June 16, 2023

| Lines of Business | Number of Claims | Number of Open Claims with Payment | Number of Open Claims without Payment | Number of Claims Closed with Payment | Number of Claims Closed without Payment | Percent of Claims Closed |

| Residential Property | 22,859 | 1,080 | 2,298 | 8,946 | 10,535 | 85.2% |

| Homeowners | 19,252 | 930 | 2,040 | 7,215 | 9,067 | 84.6% |

| Dwelling | 2,288 | 113 | 219 | 900 | 1,056 | 85.5% |

| Mobile Homeowners | 1,224 | 35 | 25 | 794 | 370 | 95.1% |

| Commercial Residential | 95 | 2 | 14 | 37 | 42 | 83.2% |

| Commercial Property | 1,298 | 108 | 455 | 186 | 549 | 56.6% |

| Private Flood | 67 | 14 | 3 | 29 | 21 | 74.6% |

| Business Interruption | 9 | 0 | 1 | 7 | 1 | 88.9% |

| Other Lines of Business* | 3,859 | 65 | 83 | 2,871 | 840 | 96.2% |

| TOTALS | 28,092 | 1,267 | 2,840 | 12,039 | 11,946 | 85.4% |

*Other Lines of Business may include Fire, Farmowners’ Multi-Peril, Ocean Marine, Inland Marine, Private Passenger Automobile Physical Damage, Commercial Auto Physical Damage, Aircraft, Glass, Boiler and Machinery, Industrial Fire, Industrial Extended Coverage, and Multi-Peril Crop.

Claims Data by County for Top 20 Counties

| County | Number of Claims | Number of Open Claims with Payment | Number of Open Claims without Payment | Number of Claims Closed with Payment | Number of Claims Closed without Payment | Percent of Claims Closed |

| Volusia | 4,168 | 137 | 548 | 1,823 | 1,660 | 83.6% |

| Brevard | 3,797 | 169 | 349 | 1,761 | 1,518 | 86.4% |

| Orange | 3,328 | 150 | 290 | 1,334 | 1,554 | 86.8% |

| Duval | 1,450 | 51 | 108 | 641 | 650 | 89.0% |

| Seminole | 1,009 | 34 | 102 | 418 | 455 | 86.5% |

| Palm Beach | 997 | 70 | 172 | 333 | 422 | 75.7% |

| Osceola | 942 | 61 | 99 | 430 | 352 | 83.0% |

| Hillsborough | 919 | 29 | 91 | 329 | 470 | 86.9% |

| Lake | 907 | 41 | 73 | 403 | 390 | 87.4% |

| Pinellas | 890 | 27 | 68 | 349 | 446 | 89.3% |

| St. Lucie | 883 | 79 | 114 | 367 | 323 | 78.1% |

| Polk | 870 | 50 | 77 | 370 | 373 | 85.4% |

| Broward | 659 | 39 | 122 | 207 | 291 | 75.6% |

| Flagler | 603 | 32 | 67 | 275 | 229 | 83.6% |

| Marion | 598 | 31 | 39 | 301 | 227 | 88.3% |

| Pasco | 585 | 27 | 33 | 226 | 299 | 89.7% |

| St. Johns | 552 | 27 | 54 | 237 | 234 | 85.3% |

| Indian River | 489 | 22 | 64 | 229 | 174 | 82.4% |

| Lee | 481 | 21 | 30 | 220 | 210 | 89.4% |

| Miami-Dade | 423 | 31 | 57 | 133 | 202 | 79.2% |

| All Other Counties | 3,542 | 139 | 283 | 1,653 | 1,467 | 88.0% |

| TOTALS | 28,092 | 1,267 | 2,840 | 12,039 | 11,946 | 85.4% |

*Other Lines of Business may include Fire, Farmowners’ Multi-Peril, Ocean Marine, Inland Marine, Private Passenger Automobile Physical Damage, Commercial Auto Physical Damage, Aircraft, Glass, Boiler and Machinery, Industrial Fire, Industrial Extended Coverage, and Multi-Peril Crop.

Total Estimated Insured Losses: $576,943,637

Data as of October 26, 2020

| Lines of Business | Number of Claims | Number of Open Claims with Payment | Number of Open Claims without Payment | Number of Claims Closed with Payment | Number of Claims Closed without Payment | Percent of Claims Closed |

| Residential Property | 57,373 | 4,895 | 14,841 | 24,526 | 13,111 | 65.6% |

| Homeowners | 47,147 | 4,103 | 11,370 | 20,434 | 11,240 | 67.2% |

| Dwelling | 8,111 | 641 | 2,488 | 3,355 | 1,627 | 61.4% |

| Mobile Homeowners | 1,380 | 125 | 369 | 692 | 194 | 64.2% |

| Commercial Residential | 735 | 26 | 614 | 45 | 50 | 12.9% |

| Commercial Property | 3,649 | 213 | 2,949 | 148 | 339 | 13.3% |

| Private Flood | 207 | 27 | 152 | 21 | 7 | 13.5% |

| Business Interruption | 50 | 10 | 15 | 16 | 9 | 50.0% |

| Other Lines of Business* | 10,719 | 2,015 | 3,124 | 4,671 | 909 | 52.1% |

| TOTALS | 71,998 | 7,160 | 21,081 | 29,382 | 14,375 | 60.8% |

*Other Lines of Business may include Fire, Farmowners’ Multi-Peril, Ocean Marine, Inland Marine, Private Passenger Automobile Physical Damage, Commercial Auto Physical Damage, Aircraft, Glass, Boiler and Machinery, Industrial Fire, Industrial Extended Coverage, and Multi-Peril Crop.

Total Estimated Insured Losses: $19,006,179

Data as of October 4, 2019

| Lines of Business | Number of Claims | Number of Open Claims with Payment | Number of Open Claims without Payment | Number of Claims Closed with Payment | Number of Claims Closed without Payment | Percent of Claims Closed |

| Residential Property | 3,113 | 165 | 1,039 | 849 | 1,060 | 61.3% |

| Homeowners | 2,615 | 138 | 853 | 739 | 885 | 62.1% |

| Dwelling | 300 | 11 | 142 | 52 | 95 | 49.0% |

| Mobile Homeowners | 192 | 16 | 40 | 57 | 79 | 70.8% |

| Commercial Residential | 6 | 0 | 4 | 1 | 1 | 33.3% |

| Commercial Property | 286 | 2 | 146 | 53 | 85 | 48.3% |

| Private Flood | 4 | 0 | 1 | 3 | 0 | 75.0% |

| Business Interruption | 23 | 0 | 7 | 0 | 16 | 69.6% |

| Other Lines of Business* | 2,338 | 124 | 664 | 1,296 | 254 | 66.3% |

| TOTALS | 5,764 | 291 | 1,857 | 2,201 | 1,415 | 62.7% |

*Other Lines of Business may include Fire, Farmowners’ Multi-Peril, Ocean Marine, Inland Marine, Private Passenger Automobile Physical Damage, Commercial Auto Physical Damage, Aircraft, Glass, Boiler and Machinery, Industrial Fire, Industrial Extended Coverage, and Multi-Peril Crop.

On multiple occasions, OIR has directed insurers with Hurricane Michael claims to not only comply with required provisions of Florida law, but to do everything possible to respond to the needs of affected Floridians and facilitate restoration and recovery in impacted communities. Please see OIR Informational Memorandum OIR-19-01M issued January 8, 2019, addressing policyholders impacted by Hurricane Michael, and Informational Memorandum OIR-19-04M issued July 25, 2019, addressing the Hurricane Michael claims response.

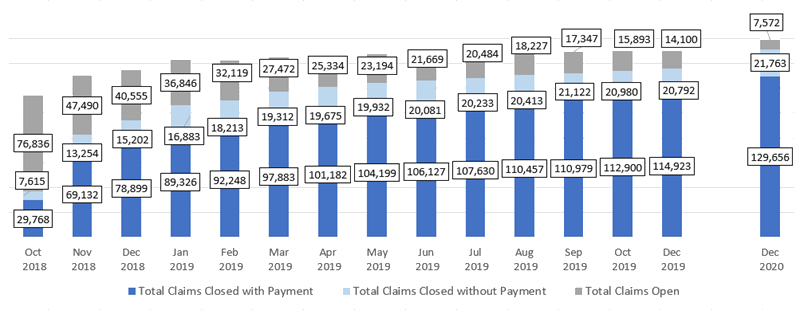

Since Hurricane Michael made landfall as a Category 5 hurricane on the Florida Panhandle on Wednesday, October 10, 2018, the OIR has conducted 46 distinct Hurricane Michael data calls. Reporting includes:

- Daily data calls beginning October 12, 2018 through November 9, 2018;

- Weekly data calls beginning November 16, 2018 through February 22, 2019;

- Bimonthly data calls from March 15, 2019 to April 26, 2019;

- Monthly calls from May 31, 2019 through October 26, 2019; and

- As requested by OIR, including the December 13, 2019, and November 2, 2020, data calls.

For the data call summary as of December 13, 2019, click here. For the data call summary as of November 12, 2019, click here.

Total Estimated Insured Losses: $9,132,526,254

Data as of November 2, 2020

| Lines of Business | Number of Claims | Number of Open Claims with Payment | Number of Open Claims without Payment | Number of Claims Closed with Payment | Number of Claims Closed without Payment | Percent of Claims Closed |

| Residential Property | 101,932 | 4,901 | 530 | 82,462 | 14,039 | 94.7% |

| Homeowners | 75,162 | 3,945 | 372 | 60,299 | 10,546 | 94.3% |

| Dwelling | 16,123 | 570 | 79 | 13,012 | 2,462 | 96.0% |

| Mobile Homeowners | 9,161 | 239 | 29 | 8,243 | 650 | 97.1% |

| Commercial Residential | 1,486 | 147 | 50 | 908 | 381 | 86.7% |

| Commercial Property | 11,873 | 1,438 | 434 | 7,236 | 2,765 | 84.2% |

| Private Flood | 598 | 7 | 2 | 426 | 163 | 98.5% |

| Business Interruption | 918 | 71 | 36 | 575 | 236 | 88.3% |

| Other Lines of Business* | 43,670 | 109 | 44 | 38,957 | 4,560 | 99.6% |

| TOTALS | 158,991 | 6,526 | 1,046 | 129,656 | 21,763 | 95.2% |

*Other Lines of Business may include Fire, Farmowners’ Multi-Peril, Ocean Marine, Inland Marine, Private Passenger Automobile Physical Damage, Commercial Auto Physical Damage, Aircraft, Glass, Boiler and Machinery, Industrial Fire, Industrial Extended Coverage, and Multi-Peril Crop.

Data as of December 13, 2019 by County

| County* | Number of Claims | Number of Open Claims with Payment | Number of Open Claims without Payment | Number of Claims Closed with Payment | Number of Claims Closed without Payment | Percent of Claims Closed |

| Bay | 95,184 | 4,795 | 522 | 80,037 | 9,830 | 94.4% |

| Calhoun | 4,429 | 102 | 31 | 3,993 | 303 | 97.0% |

| Franklin | 2,404 | 52 | 9 | 1,454 | 889 | 97.5% |

| Gadsden | 6,398 | 229 | 60 | 5,034 | 1,075 | 95.5% |

| Gulf | 7,810 | 358 | 20 | 6,227 | 1,205 | 95.2% |

| Holmes | 1,169 | 22 | 16 | 893 | 238 | 96.7% |

| Jackson | 14,834 | 526 | 57 | 12,964 | 1,287 | 96.1% |

| Jefferson | 192 | 1 | 2 | 134 | 55 | 98.4% |

| Leon | 10,569 | 128 | 91 | 7,353 | 2,997 | 97.9% |

| Liberty | 1,220 | 14 | 1 | 1,092 | 113 | 98.8% |

| Madison | 51 | 1 | 0 | 36 | 14 | 98.0% |

| Taylor | 70 | 0 | 0 | 52 | 18 | 100.0% |

| Wakulla | 1,444 | 13 | 5 | 1,011 | 415 | 98.8% |

| Washington | 3,546 | 71 | 35 | 2,976 | 464 | 97.0% |

| Rest of the State | 9,671 | 214 | 197 | 6,400 | 2,860 | 95.8% |

| TOTAL | 158,991 | 6,526 | 1,046 | 129,656 | 21,763 | 95.2% |

*Hamilton and Suwannee counties have been removed due to claims of Trade Secret.

Hurricane Michael Claims Status by Filing Deadline

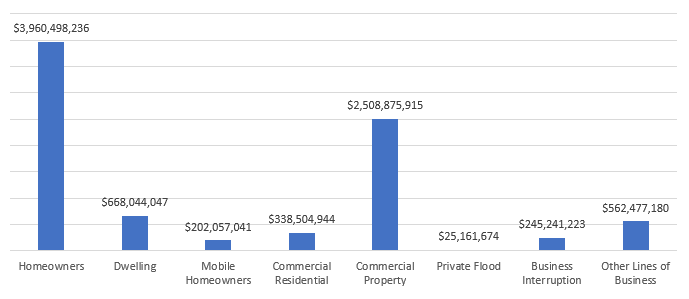

Paid Losses by Line of Business

Total Paid Losses: $8,510,860,259

Paid losses include indemnity payments but excludes loss adjustment expenses.

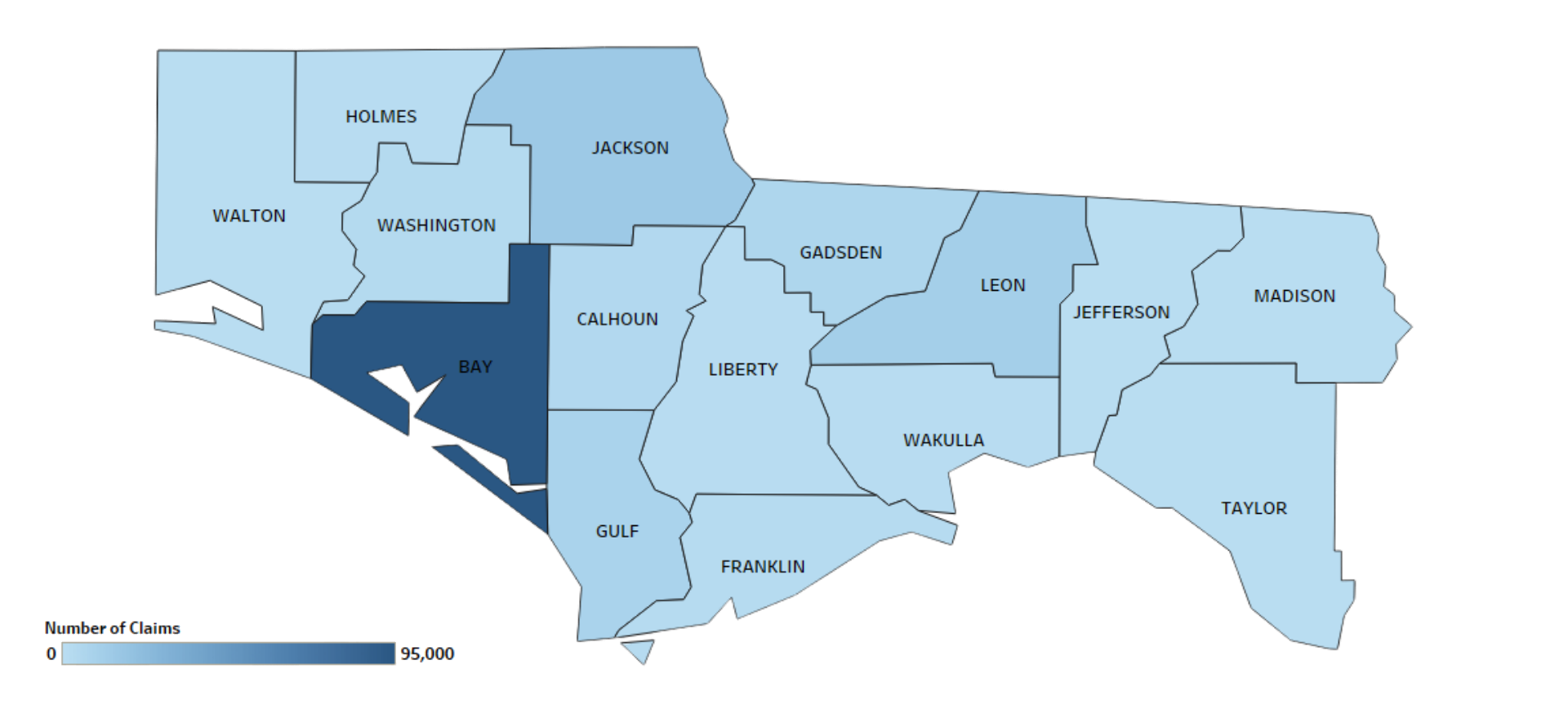

Total Number of Claims in Panhandle Region

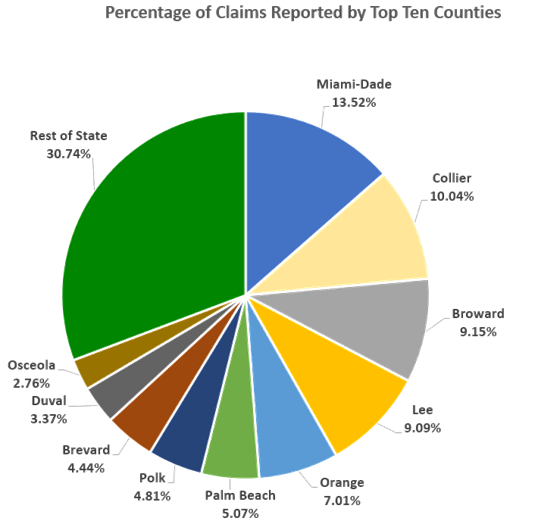

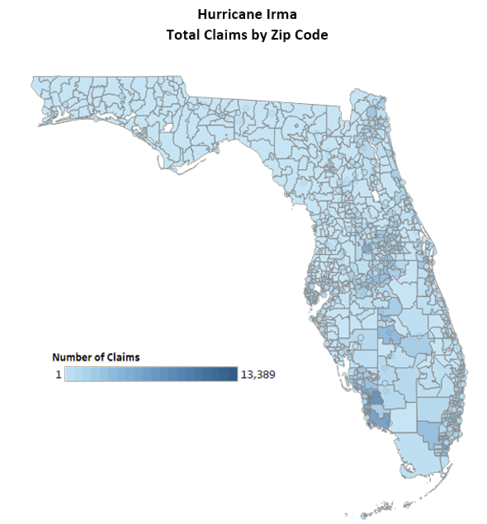

There were 149,320 claims reported in the Panhandle region. Please note, the numbers in the legend are an approximation of the claims and not the actual number of claims due to trade secret protections. Boundaries are presented by zip code.

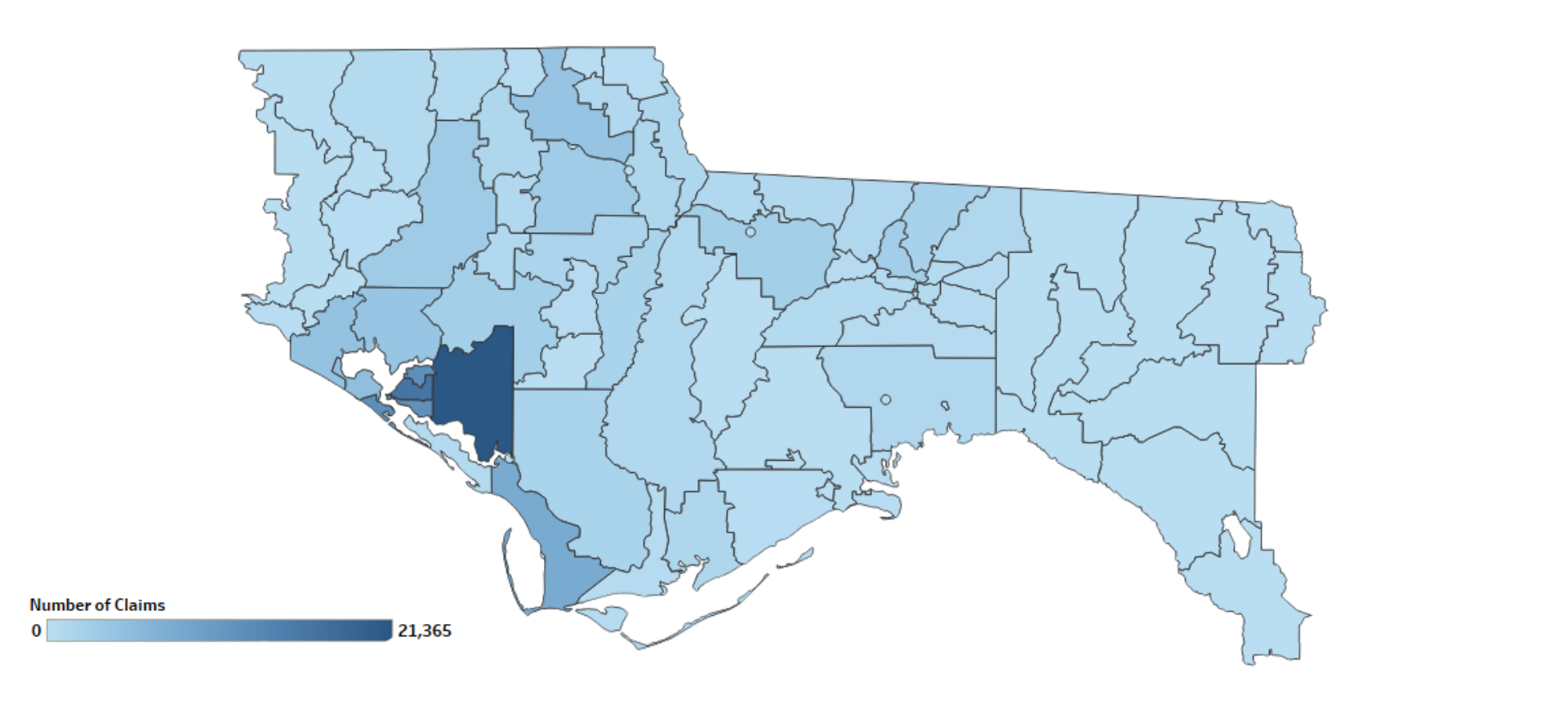

Total Claims Reported by Zip Code

Total Open Claims by Zip Code

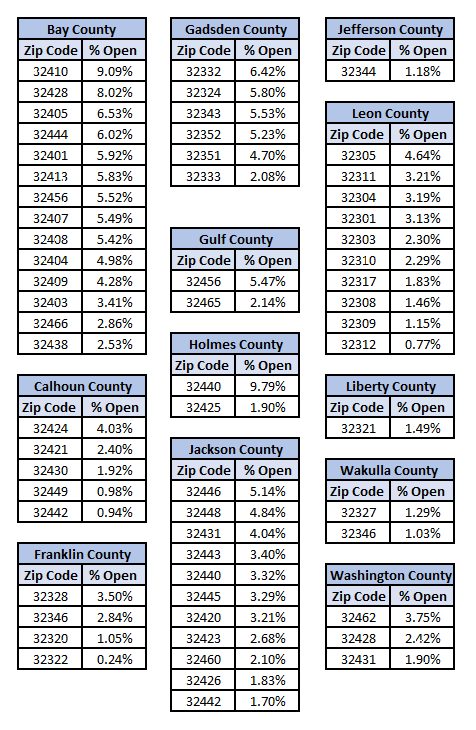

Below represents the reported percent of open claims by zip code as compared to the total number of claims filed, for zip codes with greater than 100 total claims. Not all insurers reported data by zip code. Zip codes with no open claims are not represented in this chart.

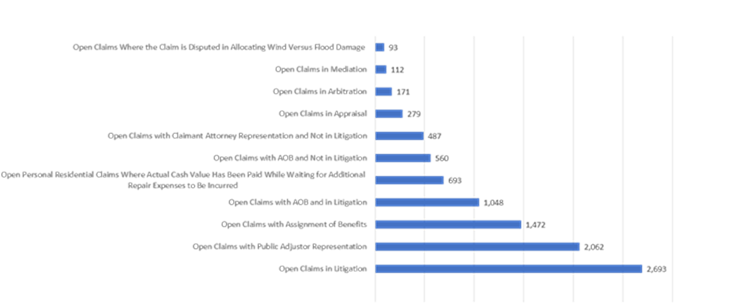

Number of Open Claims by Category for All Lines of Business

Total Estimated Insured Losses: $20,674,792,954

| Lines of Business | Number of Claims | Number of Open Claims with Payment | Number of Open Claims without Payment | Number of Claims Closed with Payment | Number of Claims Closed without Payment | Percent of Claims Closed |

| Residential Property | 955,852 | 17,164 | 25,900 | 619,652 | 293,136 | 95.5% |

| Homeowners | 774,327 | 14,347 | 22,139 | 494,754 | 243,087 | 95.3% |

| Dwelling | 121,940 | 2,185 | 2,971 | 80,986 | 35,798 | 95.8% |

| Mobile Homeowners | 48,572 | 149 | 43 | 38,683 | 9,697 | 99.6% |

| Commercial Residential | 11,013 | 483 | 747 | 5,229 | 4,554 | 88.8% |

| Commercial Property | 62,949 | 1,989 | 1,655 | 28,572 | 30,733 | 94.2% |

| Private Flood | 1,799 | 7 | 4 | 1,086 | 702 | 99.4% |

| Business Interruption | 3,827 | 23 | 10 | 2,074 | 1,720 | 99.1% |

| Other Lines of Business | 101,161 | 125 | 219 | 78,402 | 22,415 | 99.7% |

| TOTALS | 1,125,588 | 19,308 | 27,788 | 729,786 | 348,706 | 95.8% |

| County | Number of Claims | Number of Open Claims with Payment | Number of Open Claims without Payment | Number of Claims Closed with Payment | Number of Claims Closed without Payment | Percent Claims Closed |

| Alachua | 4,412 | 13 | 17 | 2,468 | 1,914 | 99.3% |

| Baker | 614 | 1 | 1 | 430 | 182 | 99.7% |

| Bay | 511 | 38 | 6 | 324 | 143 | 91.4% |

| Bradford | 899 | 0 | 0 | 554 | 345 | 100.0% |

| Brevard | 50,018 | 490 | 230 | 35,983 | 13,315 | 98.6% |

| Broward | 103,023 | 2,815 | 5,775 | 60,902 | 33,531 | 91.7% |

| Charlotte | 9,714 | 70 | 212 | 5,561 | 3,871 | 97.1% |

| Citrus | 2,650 | 3 | 7 | 1,414 | 1,226 | 99.6% |

| Clay | 9,411 | 40 | 22 | 5,969 | 3,830 | 99.3% |

| Collier | 112,957 | 2,051 | 2,046 | 85,348 | 23,512 | 96.4% |

| Columbia | 1,071 | 1 | 1 | 691 | 378 | 99.8% |

| DeSoto | 1,749 | 8 | 3 | 1,144 | 594 | 99.4% |

| Dixie | 250 | 0 | 0 | 172 | 78 | 100.0% |

| Duval | 37,905 | 213 | 113 | 23,503 | 14,076 | 99.1% |

| Escambia | 439 | 1 | 0 | 303 | 135 | 99.8% |

| Flagler | 7,206 | 89 | 34 | 4,569 | 2,514 | 98.3% |

| Franklin | 44 | 1 | 0 | 14 | 29 | 97.7% |

| Gadsden | 257 | 2 | 0 | 146 | 109 | 99.2% |

| Gilchrist | 211 | 0 | 0 | 149 | 62 | 100.0% |

| Glades | 3,096 | 9 | 0 | 2,721 | 366 | 99.7% |

| Gulf | 34 | 5 | 0 | 17 | 12 | 85.3% |

| Hamilton | 235 | 0 | 0 | 175 | 60 | 100.0% |

| Hardee | 2,199 | 15 | 11 | 1,568 | 605 | 98.8% |

| Hendry | 3,795 | 33 | 18 | 2,921 | 823 | 98.7% |

| Hernando | 2,949 | 15 | 14 | 1,535 | 1,385 | 99.0% |

| Highlands | 17,478 | 74 | 33 | 13,035 | 4,336 | 99.4% |

| Hillsborough | 21,485 | 220 | 291 | 11,154 | 9,820 | 97.6% |

| Holmes | 68 | 0 | 0 | 44 | 24 | 100.0% |

| Indian River | 6,405 | 48 | 37 | 4,107 | 2,213 | 98.7% |

| Jackson | 199 | 5 | 0 | 110 | 84 | 97.5% |

| Jefferson | 145 | 0 | 0 | 94 | 51 | 100.0% |

| Lafayette | 103 | 0 | 0 | 79 | 24 | 100.0% |

| Lake | 25,259 | 152 | 71 | 17,429 | 7,607 | 99.1% |

| Lee | 102,319 | 1,856 | 4,051 | 67,046 | 29,366 | 94.2% |

| Leon | 1,265 | 3 | 10 | 716 | 536 | 99.0% |

| Levy | 575 | 0 | 3 | 392 | 180 | 99.5% |

| Madison | 235 | 0 | 0 | 163 | 72 | 100.0% |

| Manatee | 9,432 | 54 | 77 | 5,438 | 3,863 | 98.6% |

| Marion | 10,373 | 50 | 33 | 5,989 | 4,301 | 99.2% |

| Martin | 5,282 | 101 | 197 | 3,208 | 1,776 | 94.4% |

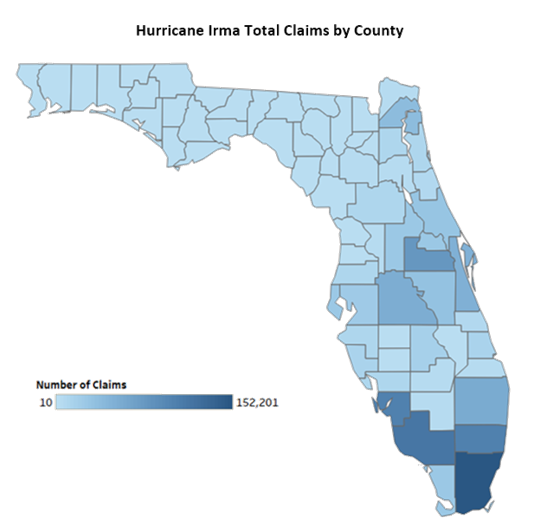

| Miami-Dade | 152,201 | 5,978 | 8,510 | 92,470 | 45,243 | 90.5% |

| Monroe | 26,643 | 402 | 108 | 16,699 | 9,434 | 98.1% |

| Nassau | 4,200 | 9 | 6 | 2,816 | 1,369 | 99.6% |

| Okaloosa | 266 | 0 | 2 | 137 | 127 | 99.2% |

| Okeechobee | 2,450 | 14 | 2 | 1,861 | 573 | 99.3% |

| Orange | 78,931 | 1,022 | 664 | 52,820 | 24,425 | 97.9% |

| Osceola | 31,056 | 542 | 255 | 22,398 | 7,861 | 97.4% |

| Palm Beach | 57,065 | 1,203 | 3,183 | 32,123 | 20,556 | 92.3% |

| Pasco | 9,486 | 42 | 45 | 5,151 | 4,248 | 99.1% |

| Pinellas | 26,354 | 143 | 116 | 14,642 | 11,453 | 99.0% |

| Polk | 54,127 | 381 | 200 | 38,686 | 14,860 | 98.9% |

| Putnam | 3,087 | 2 | 2 | 2,066 | 1,017 | 99.9% |

| St. Johns | 11,022 | 38 | 33 | 6,987 | 3,964 | 99.4% |

| St. Lucie | 15,070 | 283 | 365 | 9,412 | 5,010 | 95.7% |

| Santa Rosa | 165 | 1 | 0 | 98 | 66 | 99.4% |

| Sarasota | 12,388 | 67 | 228 | 6,230 | 5,863 | 97.6% |

| Seminole | 27,035 | 276 | 245 | 17,165 | 9,349 | 98.1% |

| Sumter | 4,467 | 10 | 9 | 2,623 | 1,825 | 99.6% |

| Suwannee | 876 | 4 | 0 | 625 | 247 | 99.5% |

| Taylor | 140 | 1 | 0 | 85 | 54 | 99.3% |

| Union | 180 | 0 | 0 | 129 | 51 | 100.0% |

| Volusia | 28,677 | 219 | 127 | 19,650 | 8,681 | 98.8% |

| Wakulla | 107 | 1 | 0 | 68 | 38 | 99.1% |

| Walton | 84 | 0 | 0 | 32 | 52 | 100.0% |

| Washington | 38 | 4 | 0 | 21 | 13 | 89.5% |

| Unknown | 23,201 | 190 | 375 | 17,207 | 5,429 | 97.6% |

| Statewide | 1,125,588 | 19,308 | 27,788 | 729,786 | 348,706 | 95.8% |

This information is compiled from claims data filed by each Insurer. It has not been audited or independently verified. This report covers all claims based on filings received as of Friday afternoon, March 3, 2017. A downloadable excel file with this data is available here. A list of companies reporting is available here. This data is final; no further requests for data have been issued.

Total Estimated Insured Losses: $139 Million

| Lines of Business | Number of Claims | Closed Claims (Paid) | Closed Claims (Not Paid) | Number Claims Open | Percent Claims Closed |

| Homeowners | 10,967 | 4,385 | 5,795 | 787 | 92.8% |

| Dwelling | 1,724 | 805 | 819 | 100 | 94.2% |

| Mobile Homeowners | 1,342 | 818 | 499 | 25 | 98.1% |

| Commercial Residential | 61 | 12 | 32 | 17 | 72.1% |

| Residential Property | 14,094 | 6,020 | 7,145 | 929 | 93.4% |

| Commercial Property | 994 | 326 | 424 | 244 | 75.5% |

| Private Flood | 195 | 133 | 46 | 16 | 91.8% |

| Federal Flood | 1,164 | 854 | 243 | 67 | 94.2% |

| Flooding | 1,359 | 987 | 289 | 83 | 93.9% |

| Business Interruption | 56 | 30 | 20 | 6 | 89.3% |

| Other Lines of Business | 3,196 | 2,501 | 562 | 133 | 95.8% |

| TOTALS | 19,699 | 9,864 | 8,440 | 1,395 | 92.9% |

| County | Number of Claims | Closed Claims (Paid) | Closed Claims (Not Paid) | Number Claims Open | Percent Claims Closed |

| Alachua | 516 | 285 | 208 | 23 | 95.5% |

| Baker | 25 | 15 | 9 | 1 | 96.0% |

| Bay | 58 | 34 | 20 | 4 | 93.1% |

| Bradford | 19 | 11 | 8 | 0 | 100.0% |

| Brevard | 147 | 65 | 64 | 18 | 87.8% |

| Broward | 112 | 44 | 45 | 23 | 79.5% |

| Calhoun | 3 | 1 | 1 | 1 | 66.7% |

| Charlotte | 67 | 30 | 27 | 10 | 85.1% |

| Citrus | 1,522 | 866 | 575 | 81 | 94.7% |

| Clay | 194 | 112 | 75 | 7 | 96.4% |

| Collier | 41 | 15 | 17 | 9 | 78.0% |

| Columbia | 159 | 108 | 49 | 2 | 98.7% |

| DeSoto | 12 | 3 | 8 | 1 | 91.7% |

| Dixie | 145 | 76 | 54 | 15 | 89.7% |

| Duval | 993 | 437 | 461 | 95 | 90.4% |

| Escambia | 31 | 17 | 10 | 4 | 87.1% |

| Flagler | 36 | 11 | 22 | 3 | 91.7% |

| Franklin | 124 | 45 | 68 | 11 | 91.1% |

| Gadsden | 152 | 88 | 62 | 2 | 98.7% |

| Gilchrist | 29 | 18 | 11 | 0 | 100.0% |

| Glades | 0 | 0 | 0 | 0 | N/A |

| Gulf | 7 | 2 | 5 | 0 | 100.0% |

| Hamilton | 82 | 50 | 31 | 1 | 98.8% |

| Hardee | 13 | 8 | 5 | 0 | 100.0% |

| Hendry | 1 | 0 | 0 | 1 | 0.0% |

| Hernando | 513 | 265 | 223 | 25 | 95.1% |

| Highlands | 24 | 12 | 11 | 1 | 95.8% |

| Hillsborough | 1,486 | 675 | 706 | 105 | 92.9% |

| Holmes | 2 | 0 | 1 | 1 | 50.0% |

| Indian River | 20 | 6 | 11 | 3 | 85.0% |

| Jackson | 18 | 11 | 6 | 1 | 94.4% |

| Jefferson | 78 | 41 | 35 | 2 | 97.4% |

| Lafayette | 32 | 26 | 6 | 0 | 100.0% |

| Lake | 227 | 122 | 96 | 9 | 96.0% |

| Lee | 106 | 37 | 46 | 23 | 78.3% |

| Leon | 3,782 | 2,077 | 1,475 | 230 | 93.9% |

| Levy | 391 | 193 | 172 | 26 | 93.4% |

| Liberty | 4 | 3 | 1 | 0 | 100.0% |

| Madison | 197 | 104 | 82 | 11 | 94.4% |

| Manatee | 663 | 373 | 239 | 51 | 92.3% |

| Marion | 313 | 160 | 144 | 9 | 97.1% |

| Martin | 20 | 11 | 8 | 1 | 95.0% |

| Miami-Dade | 138 | 52 | 56 | 30 | 78.3% |

| Monroe | 5 | 2 | 3 | 0 | 100.0% |

| Nassau | 73 | 43 | 27 | 3 | 95.9% |

| Okaloosa | 28 | 11 | 11 | 6 | 78.6% |

| Okeechobee | 11 | 3 | 6 | 2 | 81.8% |

| Orange | 526 | 220 | 274 | 32 | 93.9% |

| Osceola | 120 | 44 | 62 | 14 | 88.3% |

| Palm Beach | 102 | 37 | 46 | 19 | 81.4% |

| Pasco | 1,484 | 621 | 773 | 90 | 93.9% |

| Pinellas | 1,959 | 816 | 1,024 | 119 | 93.9% |

| Polk | 353 | 177 | 157 | 19 | 94.6% |

| Putnam | 48 | 24 | 18 | 6 | 87.5% |

| Santa Rosa | 51 | 13 | 7 | 31 | 39.2% |

| Sarasota | 364 | 158 | 160 | 46 | 87.4% |

| Seminole | 150 | 56 | 79 | 15 | 90.0% |

| St. Johns | 145 | 72 | 65 | 8 | 94.5% |

| St. Lucie | 35 | 11 | 22 | 2 | 94.3% |

| Sumter | 54 | 28 | 25 | 1 | 98.1% |

| Suwannee | 197 | 142 | 50 | 5 | 97.5% |

| Taylor | 440 | 244 | 174 | 22 | 95.0% |

| Union | 14 | 10 | 4 | 0 | 100.0% |

| Volusia | 124 | 52 | 66 | 6 | 95.2% |

| Wakulla | 391 | 227 | 141 | 23 | 94.1% |

| Walton | 8 | 2 | 5 | 1 | 87.5% |

| Washington | 8 | 6 | 1 | 1 | 87.5% |

| Unknown | 507 | 336 | 87 | 84 | 83.4% |

| Statewide | 19,699 | 9,864 | 8,440 | 1,395 | 92.9% |

This information is compiled from claims data filed by each Insurer. It has not been audited or independently verified. This report covers all claims based on filings received as of Friday afternoon, March 3, 2017. A downloadable excel file with this data is available here. A list of companies reporting is available here. This data is final; no further requests for data have been issued.

Total Estimated Insured Losses: $1.182 Billion

| Lines of Business | Number of Claims | Closed Claims (Paid) | Closed Claims (Not Paid) | Number Claims Open | Percent Claims Closed |

| Homeowners | 82,957 | 43,838 | 33,322 | 5,797 | 93.0% |

| Dwelling | 11,383 | 6,719 | 3,857 | 807 | 92.9% |

| Mobile Homeowners | 6,599 | 4,917 | 1,461 | 221 | 96.7% |

| Commercial Residential | 515 | 102 | 195 | 218 | 57.7% |

| Residential Property | 101,454 | 55,576 | 38,835 | 7,043 | 93.1% |

| Commercial Property | 6,698 | 1,295 | 2,480 | 2,923 | 56.4% |

| Private Flood | 145 | 94 | 41 | 10 | 93.1% |

| Federal Flood | 3,288 | 2,158 | 865 | 265 | 91.9% |

| Flooding | 3,433 | 2,252 | 906 | 275 | 92.0% |

| Business Interruption | 229 | 60 | 103 | 66 | 71.2% |

| Other Lines of Business | 7,531 | 4,634 | 1,864 | 1,033 | 86.3% |

| TOTALS | 119,345 | 63,817 | 44,188 | 11,340 | 90.5% |

| County | Number of Claims | Closed Claims (Paid) | Closed Claims (Not Paid) | Number Claims Open | Percent Claims Closed |

| Alachua | 199 | 93 | 93 | 13 | 93.5% |

| Baker | 49 | 31 | 15 | 3 | 93.9% |

| Bay | 17 | 6 | 10 | 1 | 94.1% |

| Bradford | 42 | 27 | 15 | 0 | 100.0% |

| Brevard | 15,967 | 9,092 | 5,410 | 1,465 | 90.8% |

| Broward | 1,046 | 348 | 531 | 167 | 84.0% |

| Calhoun | 6 | 2 | 3 | 1 | 83.3% |

| Charlotte | 36 | 17 | 18 | 1 | 97.2% |

| Citrus | 41 | 22 | 18 | 1 | 97.6% |

| Clay | 2,751 | 1,472 | 1,132 | 147 | 94.7% |

| Collier | 41 | 18 | 17 | 6 | 85.4% |

| Columbia | 44 | 23 | 19 | 2 | 95.5% |

| DeSoto | 8 | 2 | 3 | 3 | 62.5% |

| Dixie | 5 | 3 | 2 | 0 | 100.0% |

| Duval | 19,090 | 9,610 | 7,893 | 1,587 | 91.7% |

| Escambia | 21 | 11 | 3 | 7 | 66.7% |

| Flagler | 7,939 | 4,309 | 2,937 | 693 | 91.3% |

| Franklin | 5 | 2 | 2 | 1 | 80.0% |

| Gadsden | 6 | 4 | 1 | 1 | 83.3% |

| Gilchrist | 4 | 2 | 2 | 0 | 100.0% |

| Glades | 6 | 3 | 3 | 0 | 100.0% |

| Gulf | 3 | 0 | 1 | 2 | 33.3% |

| Hamilton | 7 | 6 | 0 | 1 | 85.7% |

| Hardee | 7 | 3 | 4 | 0 | 100.0% |

| Hendry | 6 | 2 | 3 | 1 | 83.3% |

| Hernando | 34 | 11 | 22 | 1 | 97.1% |

| Highlands | 51 | 24 | 25 | 2 | 96.1% |

| Hillsborough | 256 | 95 | 125 | 36 | 85.9% |

| Holmes | 1 | 0 | 0 | 1 | 0.0% |

| Indian River | 2,180 | 1,051 | 878 | 251 | 88.5% |

| Jackson | 11 | 6 | 1 | 4 | 63.6% |

| Jefferson | 1 | 1 | 0 | 0 | 100.0% |

| Lafayette | 0 | 0 | 0 | 0 | N/A |

| Lake | 864 | 406 | 401 | 57 | 93.4% |

| Lee | 75 | 27 | 39 | 9 | 88.0% |

| Leon | 88 | 20 | 35 | 33 | 62.5% |

| Levy | 20 | 12 | 8 | 0 | 100.0% |

| Liberty | 0 | 0 | 0 | 0 | N/A |

| Madison | 6 | 1 | 5 | 0 | 100.0% |

| Manatee | 81 | 34 | 42 | 5 | 93.8% |

| Marion | 364 | 174 | 165 | 25 | 93.1% |

| Martin | 859 | 442 | 345 | 72 | 91.6% |

| Miami-Dade | 794 | 249 | 363 | 182 | 77.1% |

| Monroe | 23 | 12 | 9 | 2 | 91.3% |

| Nassau | 1,881 | 1,007 | 681 | 193 | 89.7% |

| Okaloosa | 15 | 8 | 3 | 4 | 73.3% |

| Okeechobee | 51 | 34 | 14 | 3 | 94.1% |

| Orange | 6,012 | 2,849 | 2,598 | 565 | 90.6% |

| Osceola | 883 | 398 | 378 | 107 | 87.9% |

| Palm Beach | 1,675 | 635 | 834 | 206 | 87.7% |

| Pasco | 113 | 33 | 74 | 6 | 94.7% |

| Pinellas | 127 | 46 | 72 | 9 | 92.9% |

| Polk | 414 | 163 | 215 | 36 | 91.3% |

| Putnam | 1,105 | 594 | 444 | 67 | 93.9% |

| Santa Rosa | 624 | 275 | 323 | 26 | 95.8% |

| Sarasota | 393 | 206 | 169 | 18 | 95.4% |

| Seminole | 3,705 | 1,717 | 1,736 | 252 | 93.2% |

| St. Johns | 10,802 | 5,421 | 4,285 | 1,096 | 89.9% |

| St. Lucie | 2,488 | 1,118 | 1,100 | 270 | 89.1% |

| Sumter | 63 | 26 | 37 | 0 | 100.0% |

| Suwannee | 14 | 1 | 12 | 1 | 92.9% |

| Taylor | 6 | 4 | 1 | 1 | 83.3% |

| Union | 6 | 4 | 2 | 0 | 100.0% |

| Volusia | 34,403 | 20,919 | 10,169 | 3,315 | 90.4% |

| Wakulla | 14 | 6 | 8 | 0 | 100.0% |

| Walton | 8 | 4 | 2 | 2 | 75.0% |

| Washington | 3 | 1 | 2 | 0 | 100.0% |

| Unknown | 1,486 | 675 | 431 | 380 | 74.4% |

| Statewide | 119,345 | 63,817 | 44,188 | 11,340 | 90.5% |

- OIR Hurricane Summary Data for CY 2004 and CY 2005 (August 2006)

- NAIC Hurricanes Katrina and Rita Final Data Collection Summary (February 2007)

- OIR Tropical Storm Fay Summary Data (October 2008)